About TVISIL

“Buy stocks for less than they are worth and hold them as long as it takes for the market to appreciate how undervalued they are.” – John Templeton

A Clear Mission

The Value Investing Sage site is dedicated to the practice of deep value investing. An approach known as Value Investing refers to the process of identifying the cheapest stocks on all major markets by analyzing their valuation multiples, which include Price Earnings Multiples (PE), Price Sales Multiples (PS) and Price Book Multiples (PB). By reading plainly, this may seem simple. Following this plain definition of Deep Value Investing could lead to capital loss for a novice investor. This is where we play a significant role.

In order to filter out the junk (risky and manipulative) stocks, we have developed several criteria. Our criteria have been developed with the assistance of experienced Professional Accountants, Financial Analysts, Research Analysts, in addition to the guidance of legends of deep value investing.

During the 1930s, Benjamin Graham popularized deep value investing through seminars and widely acclaimed books, such as The Intelligent Investor and Security Analysis. Following Graham, many famous deep value investors purchased beaten-down securities for fractions of their value, earning the highest returns of their careers. Walter Schloss, Warren Buffett, Charlie Munger, Seth Klarman, and John Templeton are some of these influential individuals.

Small investors can learn about deep value investing from Value Investing Sage. Investing in deep value stocks can be a bit of a challenge for those of us without experience, which is why we also offer subscription service by our monthly Investment Letter (TVISIL) which offers investment analysis on international deep value stocks.

Our Strategies

This is an excellent set of strategies that can be leveraged for long-term growth. We have focused our efforts on strategies with a long-term track record of performance of more than a century. If you choose any of these options (or all of them! ), you should be able to achieve considerably better returns than you could achieve with Buffett’s Moats. Despite the fees, of course.

These strategies are based on classic Deep Value Investing strategies that have been proven in both academic research and in successful application by legendary investors such as Benjamin Graham and many of his disciples over the years. This is a list of the most successful strategies we have observed among Small, Medium, and Large Cap companies.

Acquirer’s Multiple

Tobias Carlisle’s Acquirer’s Multiple takes both EV/EBIT and EV/EBITDA into account and looks for companies that suit activist investors and private equity. Companies in this category are trading at extremely low prices in relation to earnings.

Pay Daddy

There is no better strategy than this for investors who want regular income from their investments. This method was developed long ago by Benjamin Graham, based on a conservative appraisal of a company’s liquidation value. He called them Net Net Stocks.

Negative EV

You get paid to own stock. The market price per share of these stocks is below the Net Cash per share, i.e. the cash and the cash equivalents of these companies exceed the market cap and total debt. A rigid system with astounding results.

Ultra

As Walter Schloss once said, the stocks that trade the lowest relative to their Book Values will produce the most profit. These firms trade at a fraction of their Net Tangible Asset Value and may also have a share buyback or insider buyback program. The results are incredibly positive.

Simple Way 2.0

Graham’s simple way strategy of 1976 is re-envisioned in our own way. This stock offers a low Price to Earnings (the Current Year’s Estimated Earnings) with a market beating Dividend Yield and less than 1.5x Price to Book Value. It has been a tremendous success.

Why These Strategies?

Why Small Investors?

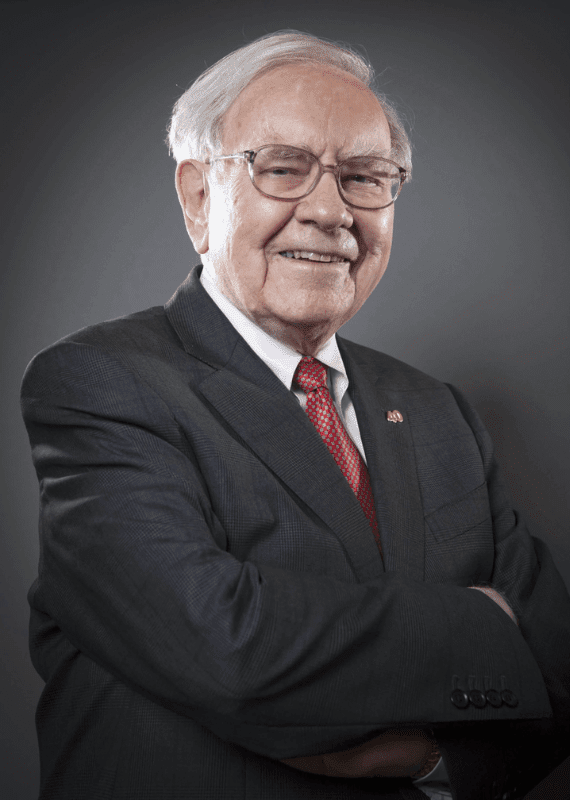

Warren Buffet

Warren buffet had some very clear advice for small investors on how they should handle their money:

” If I were working with small sums, I certainly would be much more inclined to look among Classic Graham stocks, very low PEs and below working capital and all that. I would do far better percentage-wise if I were working with small sums … you have thousands and thousands of potential opportunities and … we have relatively few possibilities in the investment world … So you have a huge advantage over me if you are working with very little money. “

It is interesting to note that many small investors ignore this significant benefit when competing up against the professionals by purchasing large-cap stocks or attempting to predict future market returns. The vast majority of small investors who use high-performance deep value strategies to invest in modest firms can beat the market, as well as most expert financial backers (Professionals who have a significant amount of money). Even so, not everyone knows how to pick their own stocks and many investors lack the opportunity to do so, even if they have the information. Our goal is to help these small investors achieve remarkable returns over their lifetime by helping them exploit high-performing deep value strategies.