Pricing & FAQ's

“Basically, we try to buy value expressed in the differential between its price and what we think its worth.”

– Walter Schloss

The Value Investing Sage Investment Letter (TVISIL)

36 Stock Analyses Per Year

Three stock analyses will be delivered to your inbox by email every month. Our experrecind team of deep value analysts scour the global markets to identify outstanding deep value stocks. The analysis includes an overview of the company, our criteria for selecting stocks, an in-depth assessment of the qualitative situation of the company, and a recommendation for buying the stock.

5 Of The Highest Returning Deep Value Strategies

An ideal choice for both professionals seeking large liquid investments for their clients, as well as individuals with small portfolios. A blend of five of the highest revenue-generating deep value strategies will be utilized for this investment: Ultra-cheap price to net tangible assets, Pay Daddy dividend Paying Net Nets, Negative Enterprise Value firms trading below distributable cash, Simple Way 2.0 stocks based on Graham’s last stock strategy, and Acquirer’s Multiple, low EV/EBITDA stocks.

12 Investment Resource Or Book Reviews Per Year

By breaking down the books we’re reading and the tools we use to do our job, we can help you become better investors. With so many books out there you may find it difficult to choose which ones to read to improve your understanding of mechanical deep value investing.

Complete Portfolio Construction & Management Guidance

Our services include finding great investment opportunities, researching stocks, analyzing them, determining when to buy, how to incorporate them into a portfolio, and when to sell them. All you have to do is execute trades. To assist you, we have included our Portfolio Construction 101 investing guide, a basic overview of how to construct a mechanical value investing portfolio, and we track all stocks for a year. Value investing is the easiest and fastest way to earn great returns.

Bird’s Eye View Investment Guides

You’ll get a bird’s-eye view into each of the investment strategies we discuss, five in total, as well as a PDF of the checklists we use for our analysis and a detailed discussion of how they were made. There is no black box. You will understand exactly how we’re selecting our stocks and why.

The Value Investing Sage Investment Letter (TVISIL)

- 3 Value Investing Sage Stock Analyses Per Month

- 5 Bird's Eye View Investment Strategy Guides

- Perfect For Financial Professionals With Clients or Small Portfolios

- Portfolio Construction 101 Investment Guide (Not Available Elsewhere)

- We Do All Of Your Investing For You - Just Make The Trades

- 12 Book Or Investment Resource Reviews Per Year

Bronze (Trial)

̶U̶S̶D̶ ̶1̶2̶0̶ Month

USD20*

- Use Code FLAT100

- 1st Month $20

- 2nd Month onwards $120

- Change Plan anytime

Silver

̶U̶S̶D̶ ̶3̶0̶0̶ Quarter

USD225*

- Use Code 25PERCENT

- 1st Quarter $225

- 2nd Quarter onwards $300

- Change Plan anytime

Gold

̶U̶S̶D̶ ̶4̶8̶0̶ Half Year

USD408*

- Use Code 15PERCENT

- 1st Half Year $408

- 2nd Half Year Onwards $480

- Change Plan anytime

Diamond

̶U̶S̶D̶ ̶7̶2̶0̶ Annual

USD648*

- Use Code 10PERCENT

- 1st Year $648

- 2nd Year onwards $648

- Change Plan anytime

Upgrade Your TVISIL Membership

$171 Off For Pro Pack Subscribers Only!

(TVIS USD720 + NNH USD600 = USD1320 Use coupon 13PERCENT)

Upgrade your membership with a subscription to The Net Net Hunter offered via our sister site Net Net Hunter. You’ll get additional access to

Shortlists of High Potential Net Net Stocks

Get quick access to the best net net stocks to research. Every month we spend 20 hours digging through 1000 NCAV stocks from 28 countries to bring you the absolute best 30 opportunities. We hand pick stocks for our Shortlist using a number of scientifically proven quality factors, and timeless investment principles from great investors such as Warren Buffett and Seth Klarman. Our foundation is very much Graham and Dodd but our focus is evidence based investing that leverages contemporary scientific studies.

Inner Circle Forums

Discuss investment ideas, net net stock investing strategies, books, and a range of other value investing topics. Our Inner Circle Forum brings together dedicated deep value investors from all over the globe. We’ve formed a high-calibre community of investors which include financial professionals, analysts, tiny fund managers, as well as regular retail investors and new investors just starting out.

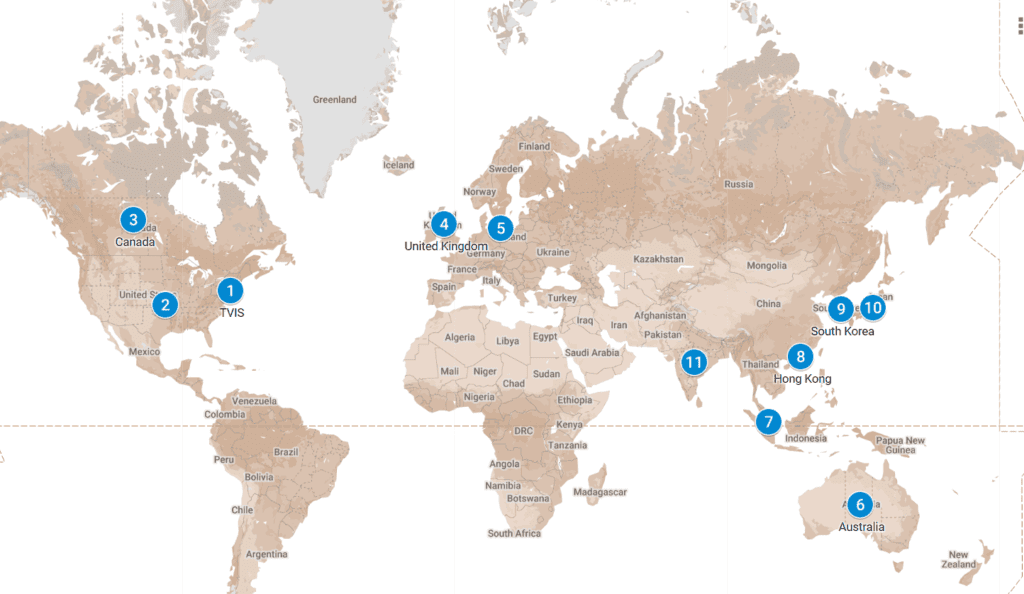

International Raw Screens

Use your own skill to identify net net stocks that meet your own particular deep value investment style. You get access to over 1500 net net stocks in the USA, the UK, Continental Europe, Canada, Australia, Singapore, Hong Kong and Japan. We cover over 28 markets and add more markets based on member demand.

Net Net Stock Educational Resources

We’ve gathered every critical piece of writing on net net stock investing to help you develop your strategy. New to investing? We have specific articles to teach you how to invest. Learn how to turn cash in the bank into a portfolio of high potential net net stocks.

Inner Circle Advice Emails

It’s incredibly important that you understand the big picture when it comes to net net stock investing so we’ve crafted this series of emails to do just that. A key part is advice on how to start if you’re new to net nets. This bird’s eye look is critical for helping you stay the course and earn exceptional long term returns. We want you to win.

Net Net Stock Research Analyses

You get 12 research analyses per year produced by Evan and our experienced value investing analysts. Each stock analysis covers a net net we’ve identified as a good buy, and we often have ownership stakes in these companies ourselves. If you’re new to net net stock investing, you can use this analysis to supplement your own net net picks or gain insight into how we think about investing.

TVISIL Diamond

̶U̶S̶D̶ ̶7̶2̶0̶

USD 648

Annual Recurring Charge

Use Code 10PERCENT

- 3 Value Investing Sage Stock Analyses Per Month

- 5 Bird's Eye View Investment Strategy Guides

- Perfect For Financial Professionals With Clients or Small Portfolios

- Portfolio Construction 101 Investment Guide (Not Available Elsewhere)

- We Do All Of Your Investing For You - Just Make The Trades

- 12 Book Or Investment Resource Reviews Per Year

- 30 of the Best Net Net Shortlisted Each Month

- Raw Screens With Over 1000 International Net Net Stocks

- Access to NNH Inner Circle Forum

- Resource Center Access With Key Writing On Net Nets

- 12 Research Reports On Choice Net Nets Per Year

- Shortlist, International Net Net, and International Discount Net Net Indices

- Access Expert Knowledge to Implement the Strategy

- Inner Circle Advice Emails

Most Popular

TVISIL Pro Pack

̶U̶S̶D̶ ̶1̶3̶2̶0̶

USD 1149

Annual Recurring Charge

Use Code 13PERCENT

- 3 Value Investing Sage Stock Analyses Per Month

- 5 Bird's Eye View Investment Strategy Guides

- Perfect For Financial Professionals With Clients or Small Portfolios

- Portfolio Construction 101 Investment Guide (Not Available Elsewhere)

- We Do All Of Your Investing For You - Just Make The Trades

- 12 Book Or Investment Resource Reviews Per Year

- 30 of the Best Net Net Shortlisted Each Month

- Raw Screens With Over 1000 International Net Net Stocks

- Access to NNH Inner Circle Forum

- Resource Center Access With Key Writing On Net Nets

- 12 Research Reports On Choice Net Nets Per Year

- Shortlist, International Net Net, and International Discount Net Net Indices

- Access Expert Knowledge to Implement the Strategy

- Inner Circle Advice Emails

Have Any Questions?

FAQ's

Answers to some common questions people have before joining.

What do you specialize in?

We’re specialists in evolving Deep Value Investing strategies, identifying stocks universally grounded on our evolved strategies, screening/ filtering them to befit our standards, penning a thorough quantitative analysis and redeeming them in the form of an Investment Letter to our subscribers, especially the Small Investors.

How many analyses do I receive each month?

We will send you one investment letter with 3 investment analyses. Each analysis is a full investment profile of the company that we identify.

Do you cover each category of stocks each month?

Yes, each Monthly Investment letter will cover One High Dividend Yield, One Cheap Earnings and One Cheap Assets stock. All of these stocks are rated “buys” and are intended for your purchase.

I don't like Micro-Cap stocks, Do you provide analysis on Large-Cap companies?

We mostly cover Micro and Nano Cap stocks. The only strategy that we cover that looks at Small, Medium and Large Cap stocks is our Simple Way 2.0 strategy. This Strategy achieves the highest CAGR.

What is your Simple Way 2.0 strategy?

Simply Graham’s original Simple Way strategy, with a few key upgrades. We look for: A Price to Current Year’s Estimated Earnings of 10x or less, an Equity to Assets Ratio of 50% or more, a Price to Book Value less than 1.5x, and a greater than market dividend yield. As with all our strategies, we also add bonus criteria to pick the best stocks.

What is the Aquirer's Multiple?

The Acquirer’s Multiple refers to two strategies: buying Low EV/EBIT and Low EV/EBITDA stocks. We add additional criteria such as insider buys or the presence of angry activists to help boost returns and the percentage of winning stocks. Tobias said these stocks returned 21.5% over 50 years, but we know we can do better.

What is your Ultra Strategy?

We buy tiny companies that are cheap on a hard assets basis after all of the firm’s liabilities have been subtracted. These firms aren’t just cheap, they’re trading at less than 40% of Net Tangible Assets. In addition, we use a range of criteria such as avoiding debt to boost returns. This is the same strategy that Walter Schloss turned to after net-nets dried up.

I don't know how to put together a Portfolio, can you help me?

Yes. We provide our Bird’s Eye View Portfolio Construction Guide to help you build and manage your portfolio. We want you to earn the best returns possible so we will walk you through how to think about this sort of investing so you can succeed long term.

What is included in each Analysis?

See for yourself! You can download your free sample edition of The Value Investing Sage Investment Letter by Subscribing to Free Newsletter.

How do you assess your stocks?

We start with strategies which have shown the best CAGR over time then check the numbers, adjust for Off Balance Sheet items, and note additional characteristics that should improve the chance of value realization. This improves returns and the chance of picking winning stocks.

Do the Analysts writing the analysis personally buy each stock?

This really depends on the Writer’s financial preferences. For every stock we analyse, we put a disclosure to tell you whether we have purchased the stock or not. We personally buy most of them that we write about and other writers or team members may buy for their own account depending upon their financial preferences.

I’m American so how can I invest internationally?

If you’re American, you can definitely invest internationally. The bulk of our members are Americans who have decided to invest overseas to leverage all these Highly Successful Deep Value Investing stocks strategies.

To help you, we’ve uncovered a number of different high quality brokers that take on American clients. These are large international brokers with strong reputations. Some of them offer very inexpensive trades while others offer additional service to high net worth clients. All of this information is available to members.

Who do I contact if I have a problem?

Contact The Value Investing Sage at Info@valueinvestingsage.com with any questions about this offer, your subscription, or anything else having to do with The Value Investing Sage.

If I don't like the service, can I get a Refund?

Considering the fact that we want you to be completely satisfied with your subscription, we suggest that you follow the following path before fully committing yourself.

- Sign up to receive a free copy of TVISIL via email.

- You can Subscribe Bronze/trial pack at USD20 only for 30 Days by using coupon code FLAT100.

- We recommend that you subscribe to annual packs if you enjoy it.

Unless otherwise specified, all of our packs are strictly non-refundable and are intended for Deep Value Investors. As members have immediate access to all investment analysis reports, refunds cannot be provided after the service has been initiated.

All policies related to NetNetHunter.com are the responsibility of NetNetHunter.com. You can obtain more information about their policy by contacting support@netnethunter.com. NetNetHunter.com is a sister site.

How long have you been around?

We started back in Sep 2016 and have been providing a reliable service since.

Our Happy Subscribers

Laura

I have been a subscriber of TVISIL for over 6 years now and I have found their investment recommendations to be quite profitable. Their average stock return of 17% per annum has been a great help in achieving my financial goals.

I have been a subscriber of TVISIL for over 5 years now and I am highly satisfied with their service. The monthly investment letter has given me great insights into the stock market and I have made some great returns from following their recommendations. Overall, I am very happy with their service and would recommend it to anyone.

William

Matthew

I subscribed TVISIL in Aug 2019. Every month, I look forward to 3 recommended buys & sells and have seen my portfolio grow substantially. Subscribed until 2024.

Our TVISIL subscription dates back to Sep 2016 (the very first edition). We consider their recommendations to be particularly impressive & rewarding. An excellent service.

Amelia