Deep Value Investing: A Guide to Uncovering Hidden Gems in the Stock Market

Value investing has been a popular strategy among investors for decades, with modern world proponents such as Warren Buffett citing its success. However, in recent years, a new approach to value investing has emerged, known as “deep value” investing. This strategy takes a more in-depth approach to traditional value investing, seeking out stocks that are undervalued and underfollowed by the market. In this article, we will explore deep value investing, its benefits, and how to implement it in your investment strategy.

What is Deep Value Investing?

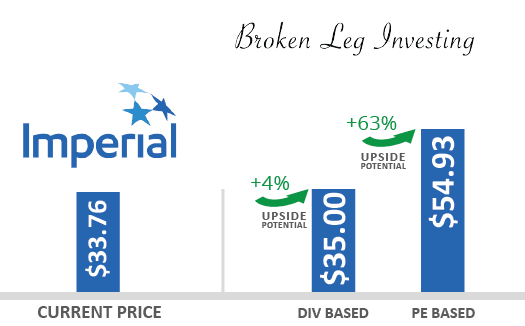

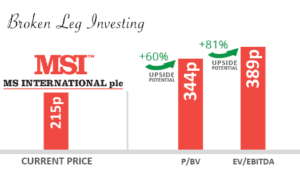

Deep value investing is a subset of value investing that focuses on finding stocks that are significantly undervalued relative to their intrinsic value. This is done by taking a deep dive into a company’s financials and operations, looking for hidden gems that have been overlooked by the market. Deep value investors believe that these companies have the potential to deliver substantial returns as the market recognizes their true value.

Why Invest in Deep Value Stocks?

- Investing in deep value stocks has several benefits. Firstly, deep value stocks are often underfollowed by analysts and investors, which can create a mispricing in the market. This can provide an opportunity for deep value investors to purchase shares at a discounted price and reap the rewards as the market corrects its mistake.

- Secondly, deep value stocks often have a high level of financial stability, which provides a margin of safety for investors. This stability is reflected in the company’s balance sheet, which shows the company has a solid foundation and is unlikely to go bankrupt.

- Finally, deep value stocks have the potential for high returns. As the market realizes the true value of the company, the stock price is likely to rise, delivering substantial returns for investors who bought in at a discounted price.

How to Implement Deep Value Investing in Your Investment Strategy

To implement deep value investing in your investment strategy, there are several steps you can follow:

- Identify potential candidates: Start by identifying companies that have been overlooked by the market and have a low price-to-book ratio. This can be done by using financial websites, such as Morningstar or Yahoo Finance, to screen for companies with low P/B ratios.

- Conduct thorough research: Once you have identified potential candidates, it is important to conduct a thorough analysis of the company’s financials, operations, and management. This will help you determine whether the company is truly undervalued and has the potential to deliver substantial returns.

- Assess the company’s intrinsic value: To determine whether a company is truly undervalued, you need to estimate its intrinsic value. This can be done by using a discounted cash flow (DCF) analysis, which takes into account the company’s future cash flows and discounts them back to present value.

- Make a decision: If the company is truly undervalued, you should consider purchasing shares. However, it is important to have a well-diversified portfolio and not to put all your eggs in one basket.

Conclusion

Deep value investing can provide investors with the opportunity to uncover hidden gems in the stock market and deliver substantial returns. By conducting thorough research and estimating the intrinsic value of a company, deep value investors can make informed investment decisions and reap the rewards as the market corrects its mistake. However, it is important to remember that deep value investing is a long-term strategy and requires patience and discipline.