Imperial Oil (IMO.TO) Target Achieved -

Buy Recommended -

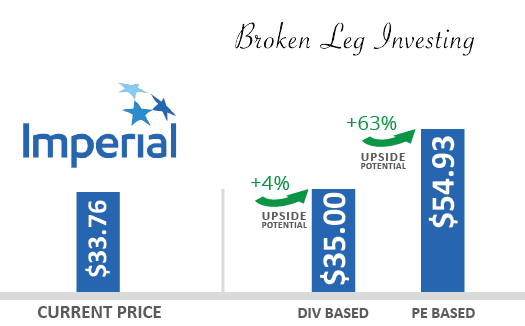

TVIS Team Analyst recommended Imperial Oil Limited (IMO.TO) at CAD$33.76 in TVISIL Sep 2021 Edition (previously known as Broken Leg Investing). Each month, Value Investing Sage analyses 3 stocks.

TVIS Analyst Explained -

“Imperial Oil Limited is an integrated oil company. It is engaged in all the phases of the petroleum industry in Canada, including exploration for, and production and sale of, crude oil and natural gas. Its operations are conducted in three segments: Upstream, Downstream, and Chemical. Imperial Oil is a well-established and profitable oil company in Canada. The low oil price hit the earnings and the stock in FY 2020. Despite the fact that the stock price recovered, it doesn’t fully reflect the better pricing environment for oil.

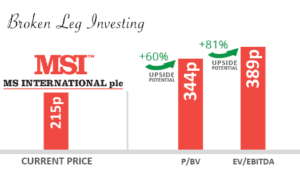

So, we have a robust, well-established firm that trades at a depressed future P/E of 9.4x, with a P/BV of 1.15x and a dividend yield of 2.9%. In addition, the balance sheet is strong with an equity to total assets ratio of 53%. Imperial Oil’s upside potential is between 4% and 63%. The diversification among different segments offers some strength to the company. In addition, the company is repurchasing its shares, a factor that can help the stock move towards its fair value. Therefore, I believe that Imperial Oil, despite not having an extremely low P/E, is an interesting stock for a well-diversified portfolio of Broken Leg stocks”

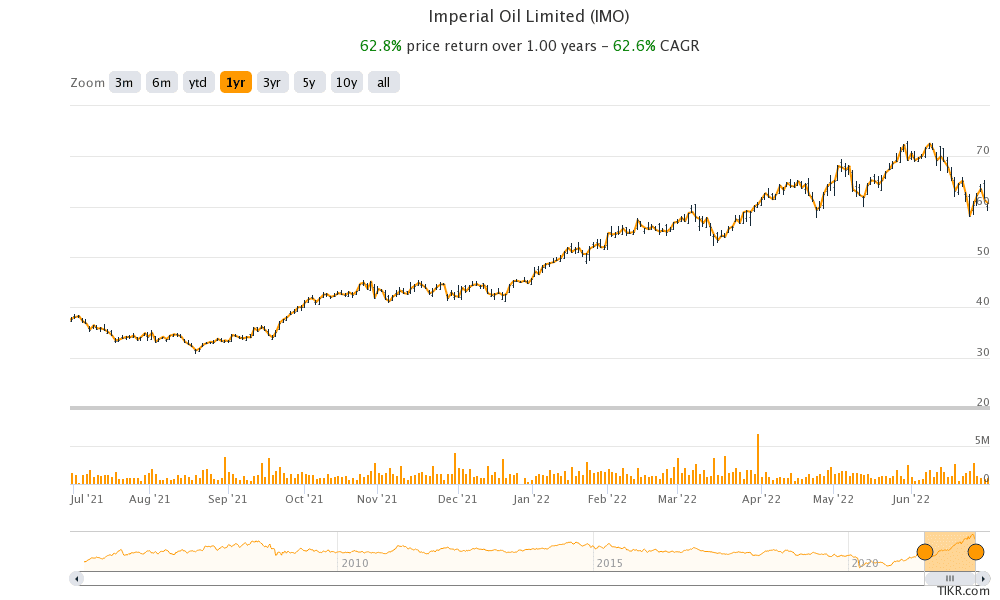

The Value Investing Sage Team originally recommended Imperial Oil Stock to its subscribers in Sep 2021 when the price was hovering around CAD$33.76, and the price didn’t return (a huge bargain). A PE valuation of CAD$54.93 was achieved in Feb 2022 (just 6 months for a 63% gain). Holding stocks for at least one year or until all valuation targets are met is part of our strategy.

We have recently begun adding targets to each stock and tracking its performance to identify potential exit strategies. Fortunately, the stock rallied and reached CAD$72.96 in May 2022 and is currently trading at CAD$60.68, an increase of almost 80% in less than a year.

Imperial Oil Stock – Positive News now -

While there is positive news now floating around about Imperial oil buying back 5% of its shares, we decided to put it to the test with our deep value investing strategy and found that today it fails on two core criteria.

Earnings due to cyclical growth – Oil prices remain high in the last year resulting in a favourable income and higher earnings per share.

Currently, the price to book value is near 2x, while the demand for our core criteria is less than 1.5x.

As a result, Imperial Oil Stock is no longer a buy, and we suggest booking profits in it at the current market price of CAD$60.68. Get such great investment picks by joining TVISIL like many other Deep Value Investors.

We wish our US subscribers a very happy Independence Day.

Best Regards

The Value Investing Sage Team