MS International Stock Target Achieved

Today, MS International achieved its revised price target.

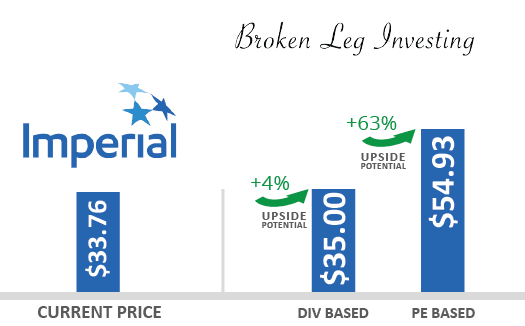

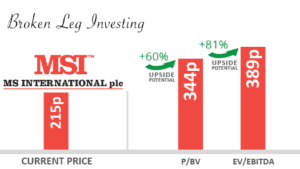

In its monthly The Value Investing Sage Investment Letter (TVISIL) for January 2022 (formerly known as Broken Leg Investing), the TVIS team recommended MS International (MSTL.L) at GBp215 per share. Value Investing Sage analyzes three stocks every month.

TVIS Analysts explained:

“MS International plc is engaged in the design and manufacture of specialist engineering products. The company’s segments include Defence, Forgings, Petrol Station Superstructures, and Corporate Branding. The company had a difficult trading period in FY2020. The restrictions of movement, both in terms of personnel and goods, negatively impacted the company’s national and widespread international trading arrangements, and MSI reported a net loss of £2.5 million. In FY2021, the company recovered to a net income of £1.1 million. Since then, TTM net income has increased further to £2.8 million. The stock has also recovered from its lows, but it is still trading at low multiples. Probably, the fact that the company is not followed by any analysts doesn’t help fundamentals to be fully reflected in the stock price.

When COVID-19 first hit the company took the appropriate measures to conserve its cash resources, but when things normalized it did something very wise. In January 2021, it repurchased 555,000 of its shares for just 113.52p per share. Most companies buy back their shares when the prices are already inflated to keep them rising, which is the wrong timing. On the contrary, MSI did it when the stock was bottoming, which is the best in terms of value creation for the shareholders, since more shares get cancelled. Well done MSI! MS International is a robust, profitable, UK company in engineering products.

So, we have come across a solid company with no debt and £14 million in cash, that is trading at a depressed EV/EBITDA of 3.2x, and with a dividend yield of 3.8%. In addition, the company is extroverted and has both high geographical and product diversification, which adds significant strength and safety.“

January 2022

Originally, the Value Investing Sage Team recommended MS International Stock to its subscribers in January 2022. The price has not returned since then (a tremendous bargain). It did reach GBp300 in April and June 2022, but our valuations were unrevised at that time. The valuation was updated recently, and we gave a revised target of GBp300. Today, August 12, 2022, this target is reached (just 8 months for a 43% gain). As part of our strategy, we hold stocks for at least one year or until all valuation targets are met. Dividends of GBp7.5 per share were included in the 43% gain.

As of Today

We are unable to evaluate the company further due to limited data available (and no future estimates). It was a very good investment that produced a 43% return in less than 8 months,The NASDAQ, on the other hand, has fallen by -17.1% over the same period. We recommend booking profits at the current market price of GBp300 in MS International since it is no longer a buy. It is the second stock to achieve its revised price target in August 2022.

Best Regards

The Value Investing Sage Team