As the US dollar rises against most European and Asian currencies, Deep Value Investors wonder whether deep value investing internationally is worthwhile?

Japanese Stocks -

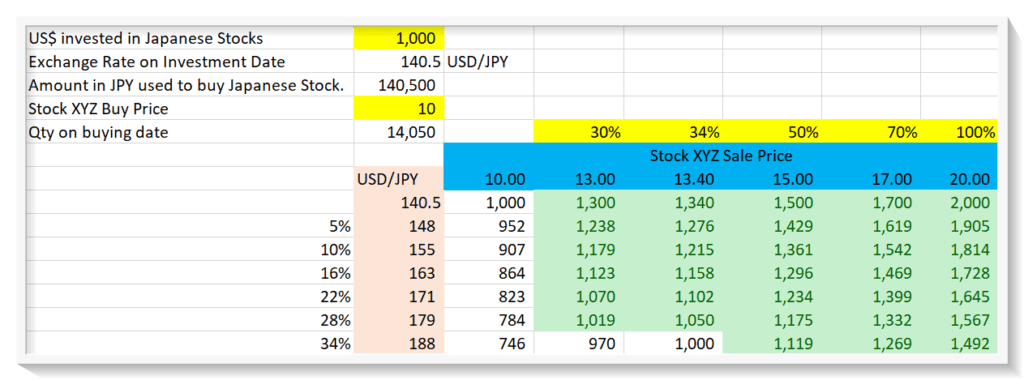

Let’s say you have 1000 dollars to invest in Japanese markets. Your USD needs to be converted into JPY before you can do that. On the date of investment, the USD/JPY exchange rate was 140.5 JPY per USD. As a result, you receive 140,500 JPY in exchange for US$ 1000. Further, you invested this amount in stock XYZ at JPY 10 per share (just an example, I wish they were that cheap.) So you ended up purchasing 14,050 shares of stock XYZ. (As a matter of simplicity, we are not including currency conversion costs and brokerage fees, which can be assumed to be between 1-3%.).

Referring to the image above, if the stock stays flat (that is at 10 JPY) over the investment period, but the JPY depreciates as shown in column B, then you will lose the amount equivalent to currency depreciation.

Deep Value Investing Internationally -

But hold on, didn’t you say you are investing in these stocks in order to earn good profits as these are deep value stocks according to the Ben Graham method, and your question was pertaining only to currency depreciation risks. Hence, we can safely assume that you will make at least 33% profits from your stock investment (from 2/3 undervaluation to fair value will convert into 50% appreciation).

So if your stock rises in price by 34% and the currency also devalues by the same % then the reslt will be zero gain zero loss. But If the stock rises by minimum 50% in price and currency depreciates by 34% (which is huge move for a currency), then you wont loose your investment but will loose your gain portion, so Deep Value Investing Internationally is still worthwhile.

Hopefully that will help you in your quest. Let us know if you still want to know about the cost of purchasing such an option, and we will write another post.

Best Regards,

The Value Investing Sage Team