Kingfisher (KGF.L) - Incredible 139-166% Profit -

Buy Recommended -

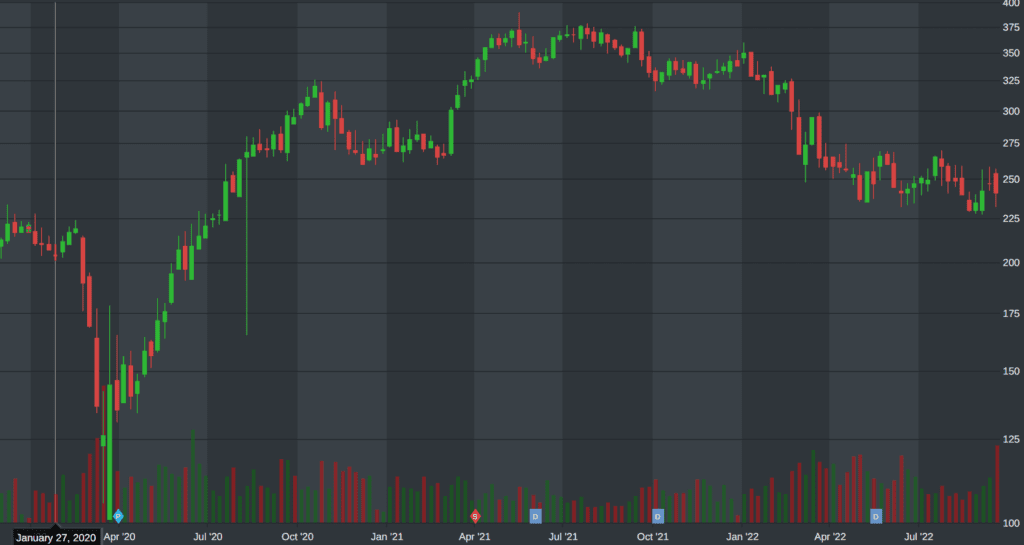

In April 2020, The Value Investing Sage (TVIS) recommended value investing in Kingfisher (KGF.L) to TVISIL subscribers at GBp 136.4 per share. Value Investing Sage analyzes three stocks every month in its monthly Investment Letter.

TVIS Analyst Explained -

The Business Problem

“Kingfisher plc is a home improvement company that operates retail stores and other channels, mainly in the United Kingdom and continental Europe. Poor performance in France, especially for Castorama stores, led to exceptional items of £190 million and transformation costs of £120 million in FY 2018/2019. These results brought statutory net profit to £218 million compared to £485 last year. Underperforming stores, Germany’s closures, and exits from Russia and Iberia accounted for impairments. Transformation costs were related to the ONE Kingfisher plan, aimed at unifying the offer across different countries. France has had a challenging unification. Brexit, negative sentiment in retail, and COVID-19 piled on top. Stores were closed due to the lockdown. This situation makes the forward earnings and dividends questionable, as with almost every company. It has announced that it will not propose a final dividend and will consider an interim dividend once it understands the scale and duration of the situation.“

Attempts to address the problem

“The company is closely monitoring the COVID-19 issue and has taken multiple cash flow mitigation measures. According to a recent announcement, it has drawn down its two revolving credit facilities totaling £775 million, bringing cash and cash equivalents to about £1.1 billion. Impairments and transformation costs have caused financial pain, but they are a good investment. Digital now accounts for 6% of total sales, and 27% for Screwfix.”

Conclusion

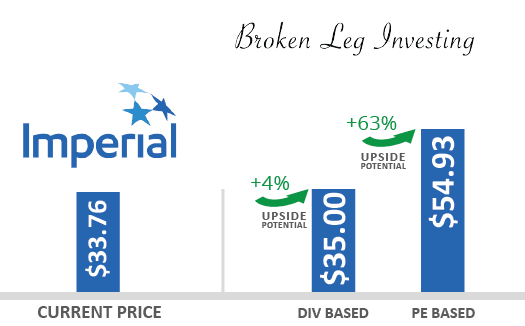

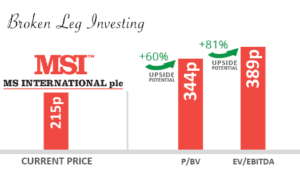

“Kingfisher is a profitable and well-established retailer in home improvement. Recently, earnings were under pressure, and COVID-19 added more uncertainty. So, we have a robust, well-established firm that trades at a depressed future P/E of 7.2x, with a P/BV of 0.48x and a dividend yield of 7.5%. In addition, the balance sheet is solid, with net cash, £2.5 billion in real estate property and an equity to total assets ratio of 52%. The company’s upside potential is between 50% and 113%. Furthermore, the company has geographically diversified revenue, which brings extra stability and safety.”

Here's what happened next -

Kingfisher did reach a high of GBp 326 on October 19, 2020 and was finally booked at GBp 325.7 in April 2021 (after 1 year), with an incredible gain of 139%. During the period, no dividends were distributed. The USD investors also ended up with a total gain of 166% (instead of 139%) as a result of currency gains. The S&P500, on the other hand, rose by 63% over the same period.

As of Today

Kingfisher is trading at GBp 241, still 77% above our first recommnded price.

Join us today and get three undervalued top picks every month.

Best Regards

The Value Investing Sage Team