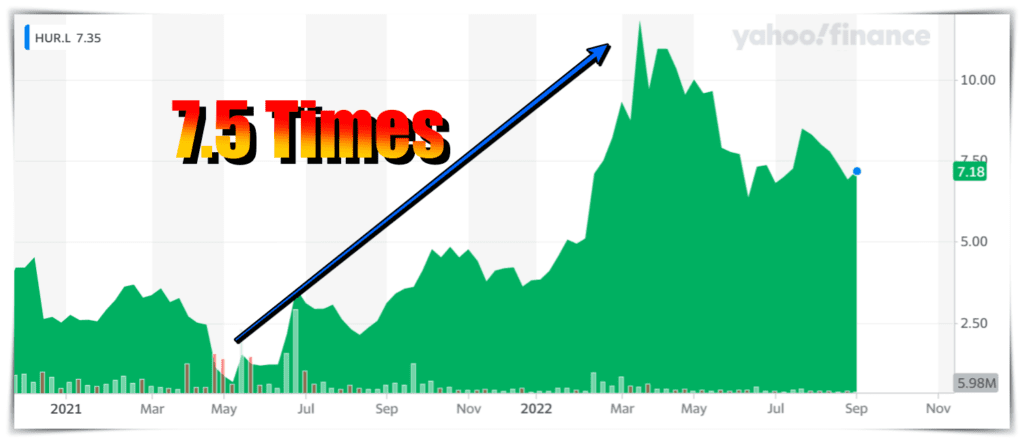

Hurricane Energy (HUR.L) - Massive 664-748% profits -

Buy Recommended -

In its monthly The Value Investing Sage Investment Letter (TVISIL) for May 2021 (formerly known as Broken Leg Investing), the TVIS team recommended Hurricane Energy at GBp1.12 per share. Value Investing Sage analyzes three stocks every month.

TVIS Analyst Explained -

“Hurricane Energy plc is engaged in the exploration of oil and gas reserves principally on the United Kingdom Continental Shelf. The company’s acreage is on the United Kingdom Continental Shelf, West of Shetland, on which the company has approximately two basement reservoir discoveries, each containing approximately 200 million barrels of oil equivalent (MMboe). Brent oil prices fell from $60/bbl in February 2020 to below $20/bbl in April 2020 due to the pandemic. Also, the company had to deal with poorer than expected reservoir performance from the Lancaster field.

New technical interpretations showed that the estimate of recovery from its two Early Production System (EPS) wells in Lancaster field has been reduced to 16.0 MMbbls from 37.3 MMbbls, meaning that in September, 2020 reserves were at 9.4 MMbbls. Similarly, the estimate of resources in the Lancaster field has been reduced to 58 MMbbls remaining from 486 MMbbls in the 2017 report. To put this into context, in the first half of FY 2020, Hurricane produced 2.66 MMbbls from its two EPS wells.

The company reported $239 million in non-cash asset impairment due to lower reserves at Lancaster and lower oil price assumptions. As a consequence, in the first half of FY 2020, Hurricane reported a loss after tax of $308 million compared to $21 million loss in the first half of FY 2019. Due to the significant losses, in just six months, the equity saw a dramatic decline from $617 million to $384 million. Low oil prices and future production levels may impact Hurricane’s ability to repay or refinance its Convertible Bond debt in full without additional funding and/or potential dilution to shareholders. Unless previously converted, redeemed or purchased and cancelled, the Convertible Bond principal of $230 million will be redeemed at par on 24 July 2022. So,there is a risk of significant dilution from the potential restructuring or partial equitisation of the bonds.

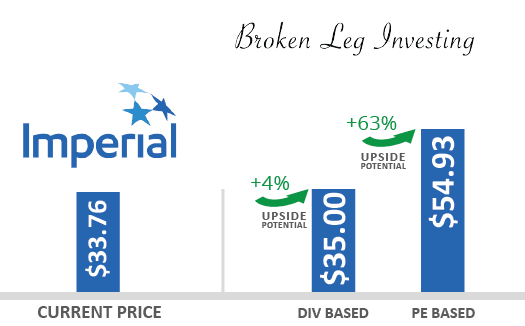

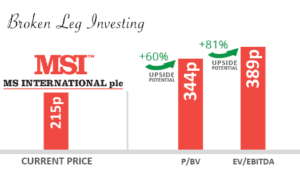

However, the lower oil price, the poorer than expected reservoir performance from the Lancaster field, and the linked impairments brought enormous non-cash losses. So, we have come across a cash flow positive company that is trading at a depressed EV/EBITDA of 1.15x and forward PE of 3.7x. As we saw, the upside potential is between 280% and 1,525%.”

Here's what happened next -

Originally, the Value Investing Sage Team recommended hurricane energy Stock to its subscribers in May 2021. It did reach GBp12.37 high by March 9, 2022 but our valuations target was not met. The price made a low of GBp0.64 by May 17 2021 and recovered back by May 26 2021. As part of our strategy, we hold stocks for at least one year or until all valuation targets are met. After 1 year, the stock was trading at GBp9.5 (for a net gain of 748%). The net gain for USD investors was 664% despite currency losses.

As of Today

Having run up nearly 7.5 times in one year, the stock is no longer deeply undervalued.It was a very good investment that produced a 748% return in 1 year, The S&P500, on the other hand, has fallen by -6.3% over the same period.

Join us today and get three undervalued top picks every month.

Best Regards

The Value Investing Sage Team