Cipher Pharmaceuticals (CPH.TO) - An average return of 22-26% Profit -

Buy Recommended -

Originally, the Value Investing Sage Team recommended Cipher Pharmaceuticals (CPH.TO) at CAD$2.29 to its subscribers in October 2021. It did reach CAD$2.80 within the same month of October 2021 but our valuations were unrevised at that time. The price made a low of CAD$1.54 in Dec 2021 and recovered back in March 2022. The valuation was updated recently (Aug 2022), and we gave a revised target of CAD$2.89. Today, September 6, 2022, this target is reached (almost 11 months and 5 days for a 26.2% gain). As part of our strategy, we hold stocks for at least one year or until all valuation targets are met.

TVIS Analyst Explained -

“Cipher Pharmaceuticals Inc. is a specialty pharmaceutical dermatology company. It has a portfolio of

commercial and late-stage products. It operates in the specialty pharmaceuticals segment. It acquires

products and compounds for the treatment of various medical needs. The company seems to be robust, cash-generative, and with strong profits. Only in the first half of 2021, Cipher produced $6.1 million in pre-tax income, when the market capitalization is just $46 million. So, the numbers do not reveal any problem.

The biggest challenge for Cipher is that its licencing revenue is heavily dependent on Absorica (US), and its product sales are dependent on Epuris (Canada). The company, presumably by recognising how undervalued the stock is, recently announced its intention to purchase for cancellation up to 10% of its public float in the following 12-month period. This seems great in terms of capital allocation when the stock is undervalued and can help it move towards the fair price. So, we have come across a solid company with no debt, repurchasing shares, and trading at a depressed EV/ EBITDA of 2.4x, and forward P/E of 5.3x.“

As of Today

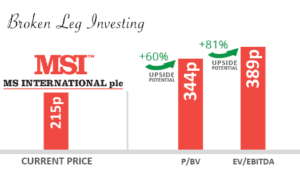

The company is not expected to do well in the next few years, and at the current price, it appears fairly valued. We will keep an eye on this to catch it again at a deep undervaluation. It was a very good investment that produced a 26% return in less than 1 year, The S&P500, on the other hand, has fallen by -10.1% over the same period. We recommend booking profits at the current market price of CAD$2.89 in Cipher Pharmaceuticals since it is no longer a buy. It is the third stock (MS International, Algoma Central Corpoeration) to achieve its revised price target.

Join us today and get three undervalued top picks every month.

Best Regards

The Value Investing Sage Team